Home Credit helps people secure loans to achieve their life goals. When it wanted to enter the U.S. market, we created a flawless, mobile-first experience to set it apart.

Our impact

- 78%

in-app self-service

- 1M+

dollars in customer support savings

- 29.8%+

weekly engagement

- 91.8%

mobile-centric

Challenge

Home Credit US is an international lender that serves customers with little or no credit history. It wanted to enter the ultracompetitive U.S. credit market — and knew that a flawless digital customer experience could help it break in and stand out. Home Credit came to us to become a mobile-first financial institution.

Solution

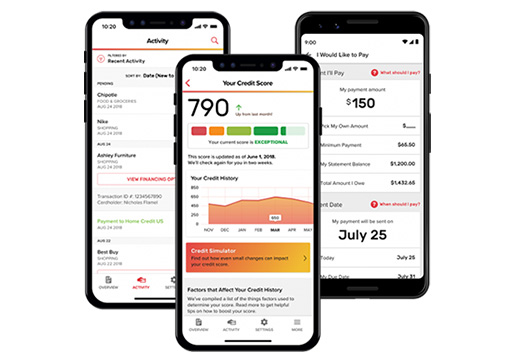

We conducted in-depth ethnographic research to create user personas for the U.S. market and identified legacy technologies to optimize for mobile. Then we developed robust middleware to make it easy for customers to engage with Home Credit on their smartphones and self-service many of their account needs.

Services provided

Results

Our research-backed approach to mobile app development worked. Even though Home Credit wasn't started in the U.S., it “spoke the language” of target customers. A strong UX drove engagement and lowered operational costs. About 85% of customers’ needs can be completed via self-service in the app, which saved the company more than $1 million in customer support costs. Over a third of customers engage with Home Credit’s app each week.